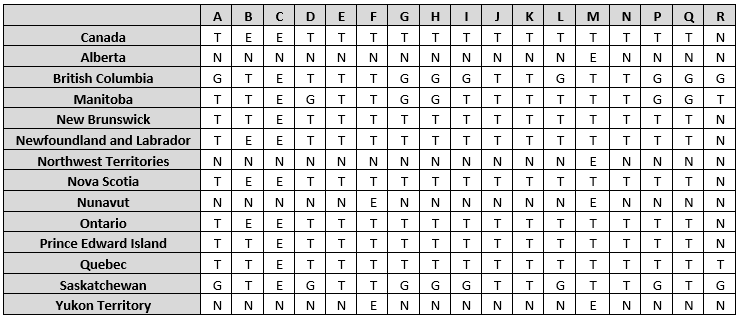

avalara tax code matrix

Avalara Streamlined Sales Tax. All rights reserved Terms and Conditions.

The tax code should be passed with a 0 line amount.

. In AvaTax go to Settings All AvaTax Settings. Aug 3 2012 Susan McLain. You can use this search page to find the Avalara codes that determine the taxability of the goods and services you sell.

Avalara Tax Research US. Upload a list of your products so Avalara can make tax code recommendations. The most common place to map an item to a tax code is the place where you maintain your master.

To assign an Avalara product tax code to a variant log into your Avalara account click Settings in the upper-right of the admin screen then click Manage items with special tax treatment. The 027 fee will automatically be calculated when this tax. After youve reviewed the tax code.

Upload a list of your products so Avalara can make tax code recommendations. Avalara a provider of sales tax and compliance automation services has acquired UPC Matrix Master the largest database of Universal Product Codes with specialized sales. This tax code is only to be used to trigger colorados 027 retail delivery fee.

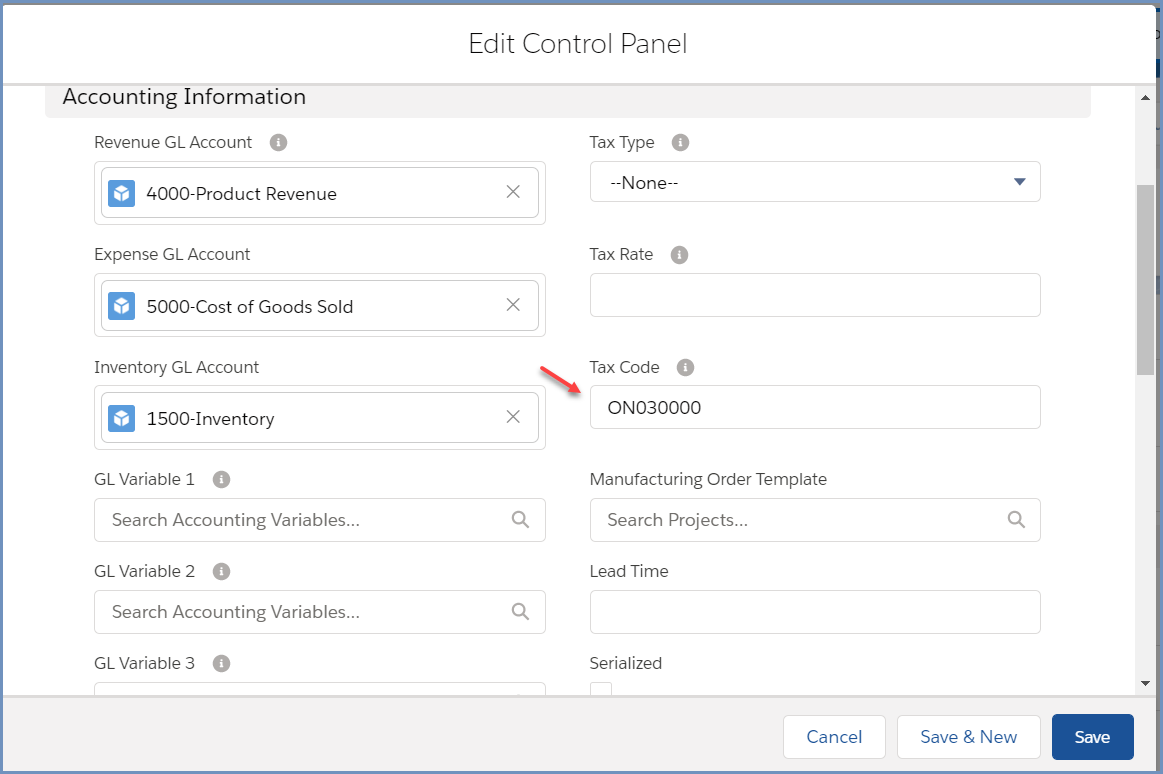

The first letter indicates the tax code type P for products D for digital Fr. Two letters to start and six numbers at the end. If you sell items such as clothing food software medical supplies software subscriptions and freight map them to Avalara tax codes to get the best sales tax rate for.

Telecom identifies whether a tax or fee is imposed on the customer or the seller and whether that fee is required or optional to be passed through to the customer. 2022 Avalara Inc. Find the right Avalara tax codes for your products and services.

In the recertification letter Rhode. Avalara for Small Business. Avalara Tax Research 2 min.

Additional Services means the Services Avalara offers under these MatrixMaster Terms in addition to the MatrixMaster Service and the Limited MatrixMaster. The tax rate on freight is adjusted proportionally so 25 of the freight charge is taxed at 625 and. Avalara Tax Research 3 min.

Next to Custom Rules select Manage. Using UPC commonly known as bar codes Avalara MatrixMaster determines taxability information for millions of products in thousands of tax jurisdictions across the US. The physical products represent 25 of the total sale and food represents 75.

Rhode Island submitted their updated taxability matrix and certificate of compliance to the Streamlined Sales Tax organization. Select Tax Rules and then select Add a Tax Rule. Enter the rule information on the.

Most Avalara tax codes are made up of eight characters. You can copy and paste a code you find here into the Tax Codes field in.

Understanding Freight Taxability Avalara Help Center

Wbavatax Avalara Avatax Tax Calcuation Integration Whmcs Marketplace

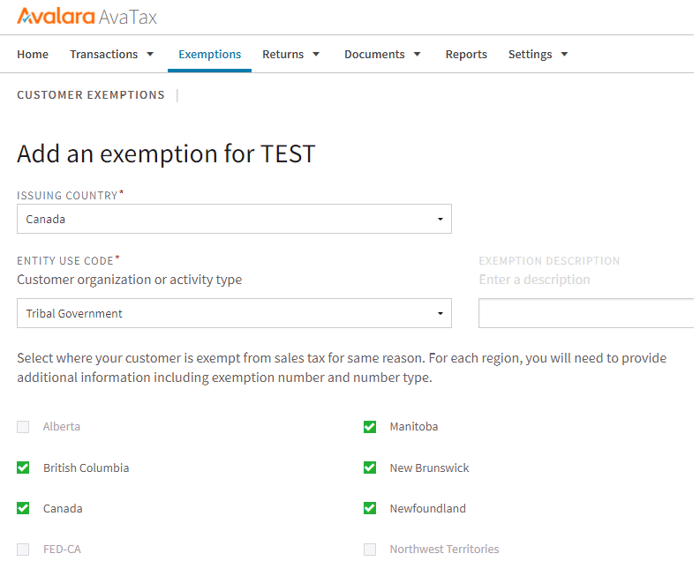

Avalara Avatax Set A Customer To Be Tax Exempt In U S And Canada

Product Business Partner And Freight Taxability With Avalara In Sap Business Bydesign Sap Blogs

Avalara Tax Code Classification And Avatax Cross Border Solutions Youtube

Avalara Managed Tax Category Classification Simplifies Product Classifications And Taxability Determinations For Businesses

Map Item To Avalara Tax Code Avatax Youtube

Avalara Avatax Set A Customer To Be Tax Exempt In U S And Canada

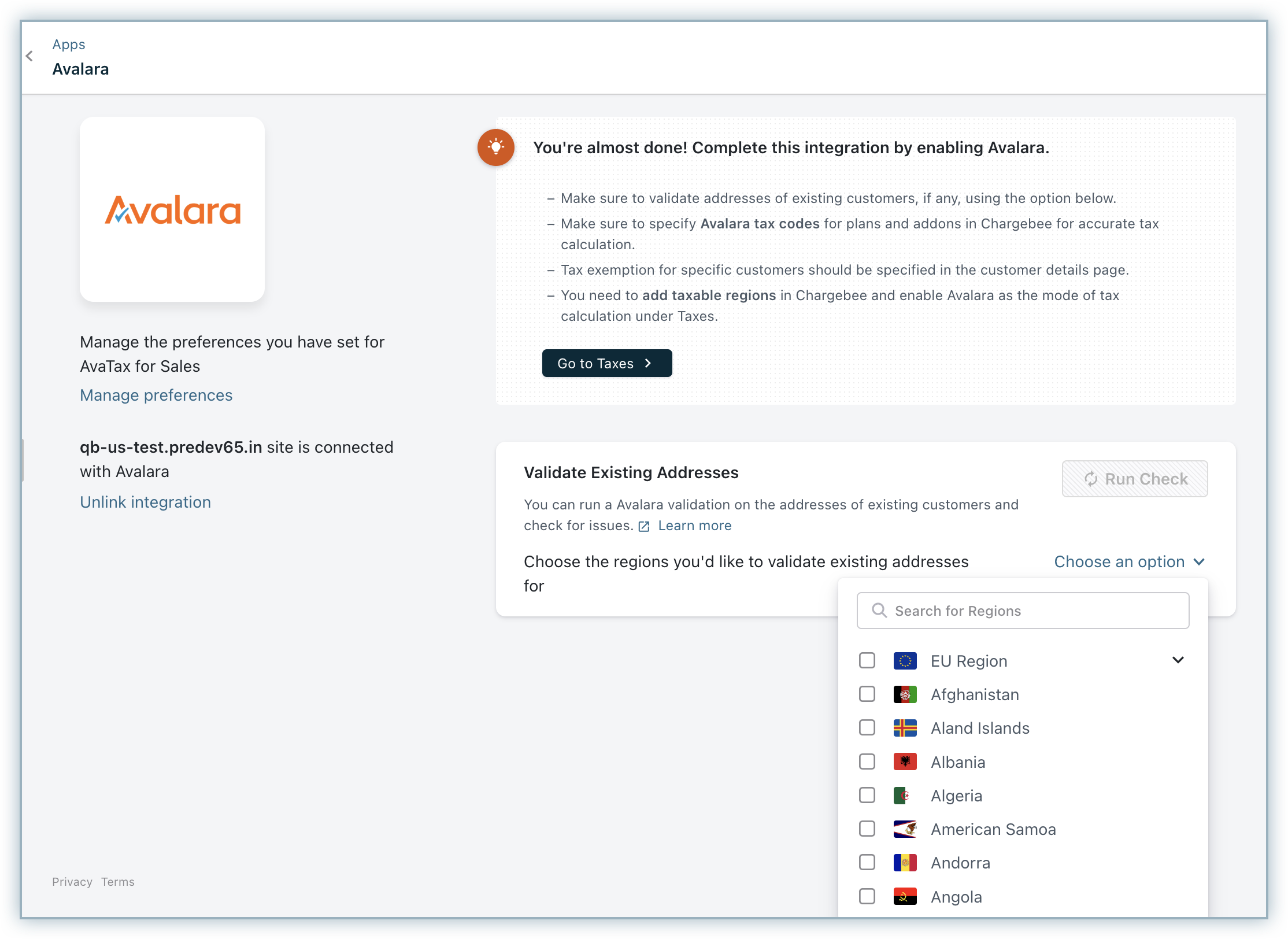

Avatax For Sales Chargebee Docs

Product Business Partner And Freight Taxability With Avalara In Sap Business Bydesign Sap Blogs

Avalara Tax Research Atr Provides A Simple Yes Or No Tax Answer For Every Product Bought Or Sold

Understanding The Avatax For Communications Tax Engine Avalara Help Center

State Online Sales Taxes In The Post Wayfair Era Tax Foundation

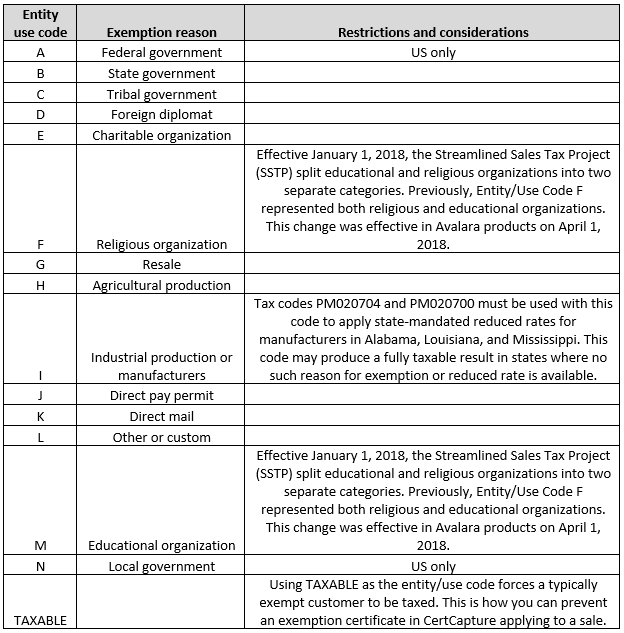

Set Up An Account Or A Product As Tax Exempt With Avatax Accounting Seed Knowledge Base

Github Mjgardner Webservice Avalara Avatax Avalara Soap Interface As Compiled Perl Methods